At this point, my guess is that the three biggest banks’ share prices are based less on estimates of realizable asset values and more on the perceived likelihood that the government will rescue the banks without admitting that they are insolvent, that nationalization — the new “n” word — will continue to be something not discussed in polite company and that existing shareholders won’t suffer the catastrophic dilution they so clearly have coming to them. Look for a jump in tomorrow’s closing prices after the announcement of Geithner’s bailout package.

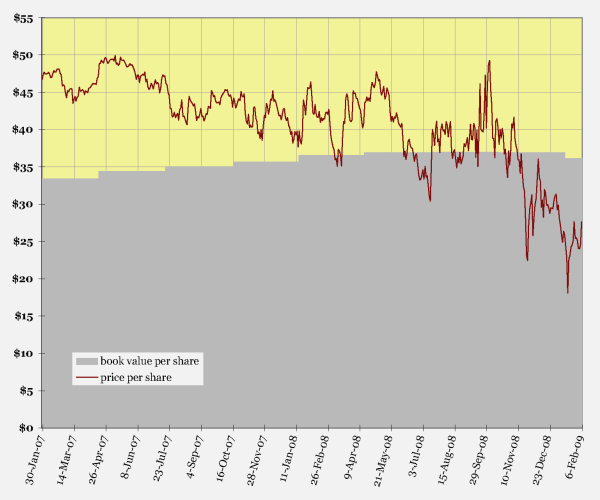

Citigroup

(currently trading at 26.6% of book value)

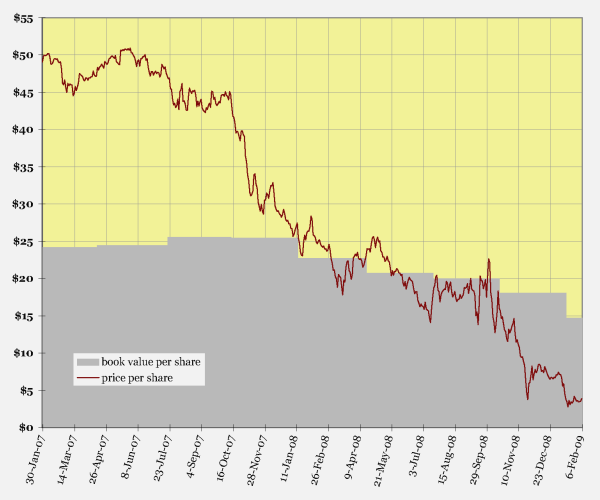

Bank of America

(currently trading at 22.1% of book value)

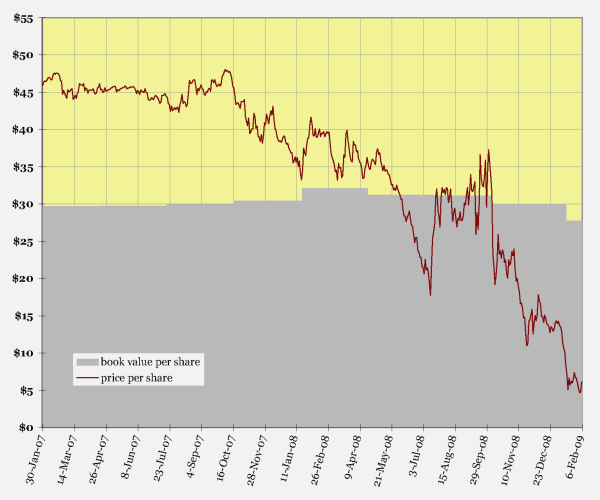

JP Morgan Chase

(currently trading at 76.4% of book value)