Economics & finance

Pitching the counterinsurgency

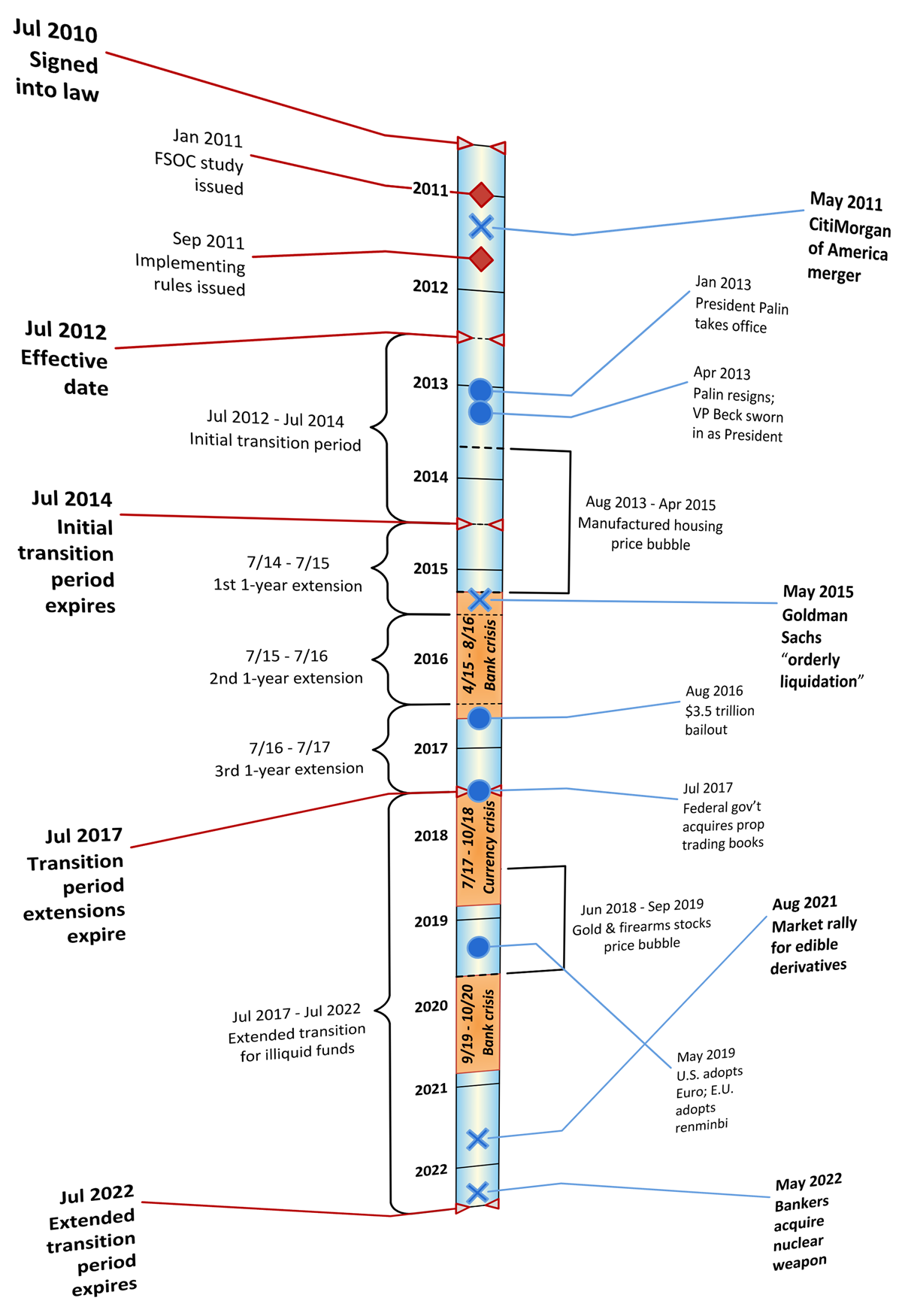

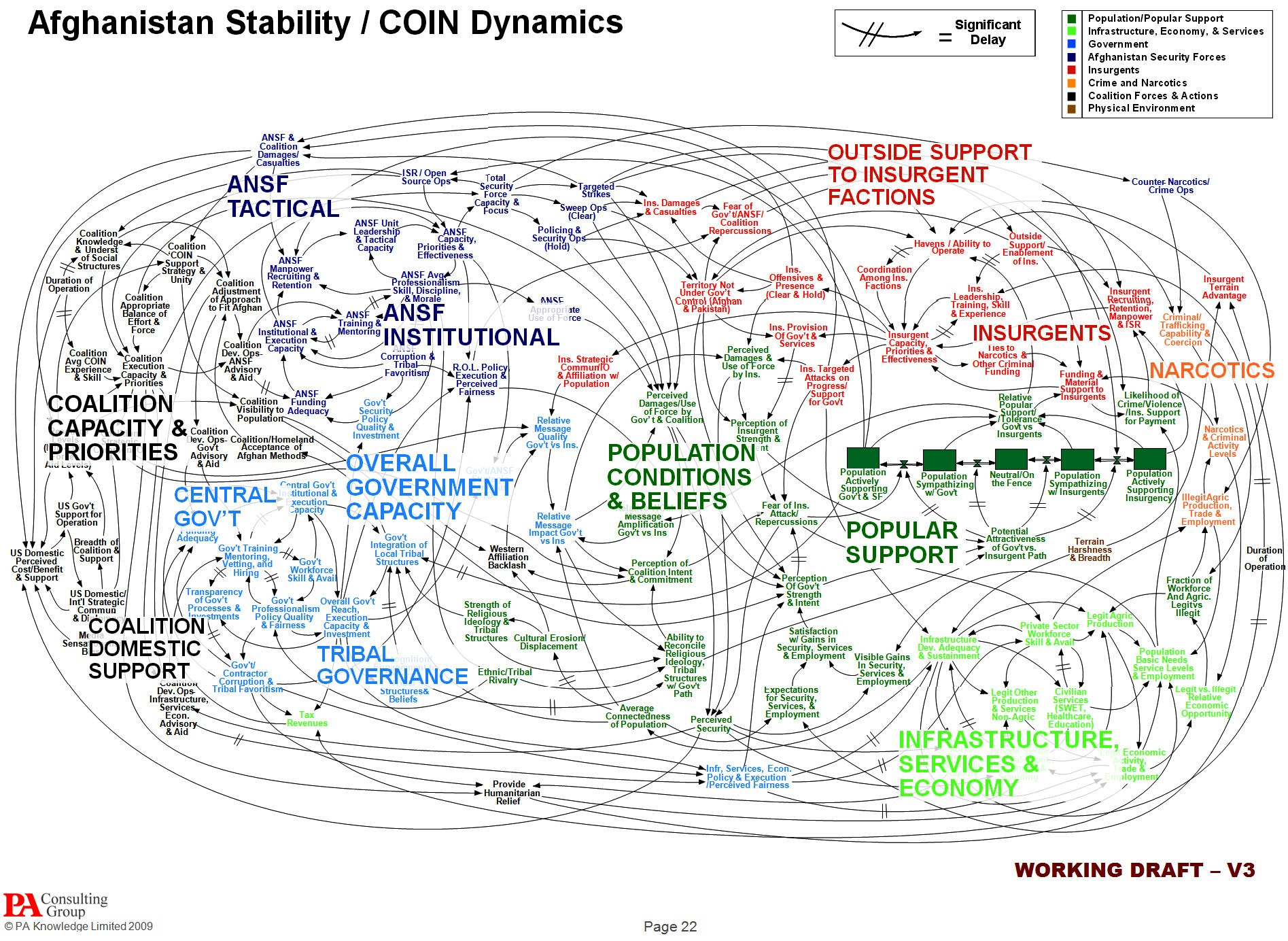

From today’s paper, the U.S. counterinsurgency strategy in Afghanistan reduced to meaningless chartjunk:

As if Edward Tufte’s diagnosis of the state of our verbal and statistical reasoning in the era of PowerPoint — “Power corrupts; PowerPoint corrupts absolutely” — needed any confirmation.

Make sentences, not bullet points.

Ideology as metaphor

Geithner re-announces his public-private plan for toxic assets. Leaving aside the boring details, the plan amounts to what?

![]() • corporate statism

• corporate statism

![]() • crony capitalism

• crony capitalism

![]() • lemon socialism

• lemon socialism

![]() • Groucho Marxism

• Groucho Marxism

The answer, of course, is … all of the above.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Blame it on animal spirits

Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as the result of animal spirits — a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.

— John Maynard Keynes, The General Theory

of Employment, Interest and Money (1936)

— Jacket art by Edward Koren from

Akerlof & Shiller, Animal Spirits (2009)

Crony capitalist of the week

The dean of the bank M&A bar speaks to the Financial Times:

“If the phrase ‘height of stupidity’ has any meaning, it would be shown if they nationalise a US bank,” said Rodgin Cohen, chairman of law firm Sullivan and Cromwell, who has advised on many of the past year’s biggest bank rescue deals and recapitalisations.

Mr Cohen stressed that the nationalisation of a large global bank had never been tested and the unintended repercussions of such a move could be severe, particularly in relation to any of the bank’s foreign subsidiaries. He favours a plan that would infuse banks with more capital and extract bad assets from their balance sheets as quickly as possible, to boost confidence in the institutions.

“Given time, these institutions have enormous earnings capacity,” he said. “If you start to take out these bad assets, we’ll start to see confidence rebuilt. It can turn around, and it will turn around.”

And when it does turn around, we want to make sure our guys are still in charge so they can privatize the gains and share them with us.

Looks like the rent-seekers have found their mouthpiece.

Second star to the right, and straight on till morning

Corporate governance icon Lucian Bebchuk gives his directions to Public-Private Neverland in “How to Make TARP II Work,” a proposed structure for private sector investors to participate in the government’s acquisition of troubled assets from banks. Prof. Bebchuk believes that an effective plan is possible based on the Public-Private Investment Fund (dimly) previewed by Treasury’s Geithner last week. One element of Bebchuk’s proposal — establishing a “significant number” of privately managed P-P funds, each financed in part by the government, to make competing bids for troubled assets — reprises a paper he published in September 2008, during the debate over TARP I.

The other, less familiar element calls first for private fund managers to compete for government financing, to make proposals that maximize private participation in the P-P funds and minimize the government’s exposure. If, for example, the government financing is in the form of a non-recourse loan, competitive bidding might result in each P-P fund being financed 60% by the government and 40% with private capital contributions, leaving the government exposed only to losses in excess of 40% of the fund portfolio’s initial value (itself the result of a competitive bidding process). To keep the interests of the government and the private sector investors aligned in a heavy-loss scenario, the 40% private participation could be split so that only ¾ is equity and the remaining ¼ is debt that ranks pari passu with the government financing. To give the government some exposure on the upside, it could acquire an equity participation in lieu of a portion of (or in addition to) its non-recourse loan. And so forth.

Bebchuk’s dual-auction structure — bid for the government financing first, and then bid for the troubled assets — promises a sophisticated mechanism for price discovery in difficult circumstances, and is appealing on both rational and emotional grounds. Designing the process and tinkering with the various parameters would be fun for a few months, and would certainly make it easier to ignore the advancing hoofbeats of the econolypse. But even if the structure ultimately results in bid prices that reflect the “fundamental” economic value of the troubled assets (i.e., the discounted present value of their expected cash flows if held to maturity), what reason is there to think that these bids will be any closer to the troubled assets’ book values — and the banks’ asking prices — than the prices available in today’s supposedly “illiquid” market? Bebchuk makes a critical assumption:

It should be stated at the outset that making this market well-functioning would not necessarily bring the banking sector to normalcy. A well-functioning market will convert some of the troubled assets held by banks into cash and, perhaps more importantly, provide more reliable valuations for the troubled assets that banks will retain. While this might confirm the claims made by some banks about the value of their assets, it might lead to realization that some other banks are insolvent or inadequately capitalized, which would require infusions of additional capital. Thus, restarting the market for troubled assets might well be insufficient by itself to solve banks’ problems, but, at the minimum, it would clarify matters a great deal, removing the clouds that currently hamper the activities of some banks while identifying those requiring an infusion of capital. In any event, for the remainder of this paper, I shall take as given the administration’s stated objective of restarting the market for troubled assets, and I shall focus on how this objective can be best achieved.

I’m afraid there isn’t time for this. If a public-private, dual-auction troubled asset acquisition plan isn’t reasonably certain to result in market-clearing prices, then it will be cheaper and more effective to nationalize now and auction off the troubled assets to private sector investors later.

Free beer!

Roubini says that if we don’t like the sound of nationalization, we should call it “receivership” instead.

Calculated Risk suggests “pre-privatization” for a slight shift in emphasis.

Yglesias goes all in:

I say we go further and call it “awesome capitalist cowboys” just to ensure that everything’s really in tune with American cultural norms. Everyone loves cowboys!

Oh, what the hell — call it a “tax cut” and let slip the stress-testers. Raise up the Resolution Trust Corporation. Party like it’s 1989.

(h/t Matt for the linguistic trend-spotting)

Rotten tomatoes for TARP II

Martin Wolf writes in today’s Financial Times:

The new plan seems to make sense if and only if the principal problem is illiquidity. Offering guarantees and buying some portion of the toxic assets, while limiting new capital injections to less than the $350bn left in the Tarp, cannot deal with the insolvency problem identified by informed observers. Indeed, any toxic asset purchase or guarantee programme must be an ineffective, inefficient and inequitable way to rescue inadequately capitalised financial institutions: ineffective, because the government must buy vast amounts of doubtful assets at excessive prices or provide over-generous guarantees, to render insolvent banks solvent; inefficient, because big capital injections or conversion of debt into equity are better ways to recapitalise banks; and inequitable, because big subsidies would go to failed institutions and private buyers of bad assets.

Why then is the administration making what appears to be a blunder? It may be that it is hoping for the best. But it also seems it has set itself the wrong question. It has not asked what needs to be done to be sure of a solution. It has asked itself, instead, what is the best it can do given three arbitrary, self-imposed constraints: no nationalisation; no losses for bondholders; and no more money from Congress. Yet why does a new administration, confronting a huge crisis, not try to change the terms of debate? This timidity is depressing. Trying to make up for this mistake by imposing pettifogging conditions on assisted institutions is more likely to compound the error than to reduce it.

TARP II: This time, it’s completely hopeless

Just when you thought it was safe to have faith in your government:

Public-Private Investment Fund: One aspect of a full arsenal approach is the need to provide greater means for financial institutions to cleanse their balance sheets of what are often referred to as “legacy” assets. Many proposals designed to achieve this are complicated both by their sole reliance on public purchasing and the difficulties in pricing assets. Working together in partnership with the FDIC and the Federal Reserve, the Treasury Department will initiate a Public-Private Investment Fund that takes a new approach.

Public-Private Capital: This new program will be designed with a public-private financing component, which could involve putting public or private capital side-by-side and using public financing to leverage private capital on an initial scale of up to $500 billion, with the potential to expand up to $1 trillion.

Private Sector Pricing of Assets: Because the new program is designed to bring private sector equity contributions to make large-scale asset purchases, it not only minimizes public capital and maximizes private capital: it allows private sector buyers to determine the price for current troubled and previously illiquid assets.

I’m sorry, but … what? Private sector buyers are already allowed to determine the price of troubled/illiquid assets — it’s just that the price they are willing to pay is well south of the price banks are willing to accept. So is the “public” component intended simply to provide liquidity to potential buyers, à la TALF, or is it really meant to influence bid prices?

Say the “side-by-side” government financing takes the form of a non-recourse loan, or a senior limited partnership interest with a fixed return. (“We are exploring a range of different structures for this program,” announced Geithner at 11:29 am, setting off a wave of panic selling.) Say the private sector holders of the equity or residual interest only have to put up a fraction of the purchase price, limiting their downside exposure, while keeping unlimited upside. Will this encourage buyers to raise their bids? Presumably, we’re talking about private equity types here, never ones to leave money on the table, but suppose — just suppose — the government stop-loss is enough to close the gap between the bid and ask prices. What an accomplishment: the government insures the private sector buyers against risk of loss, the buyers generously offer to share their subsidy with the banks that sell the troubled/illiquid assets, and the taxpayer (oh, yeah … her) gets an upside participation in nothing at all.

What’s more likely, of course, is that the government financing/subsidy won’t result in bids high enough to persuade many banks to sell, because to sell would be to realize huge embedded losses, and to realize such losses would be to face insolvency. Which brings us back, after a long detour through Public-Private Neverland, to the actual centerpiece of the Financial Stability Plan, the nuke in its “arsenal” of financial resources, carefully camouflaged behind a screen of incoherent prose:

Capital Assistance Program: While banks will be encouraged to access private markets to raise any additional capital needed to establish this buffer, a financial institution that has undergone a comprehensive “stress test” will have access to a Treasury provided “capital buffer” to help absorb losses and serve as a bridge to receiving increased private capital. While most banks have strong capital positions, the Financial Stability Trust will provide a capital buffer that will operate as a form of “contingent equity” to ensure firms the capital strength to preserve or increase lending in a worse than expected economic downturn. Firms will receive a preferred security investment from Treasury in convertible securities that they can convert into common equity if needed to preserve lending in a worse-than-expected economic environment. This convertible preferred security will carry a dividend to be specified later and a conversion price set at a modest discount from the prevailing level of the institution’s stock price as of February 9, 2009. Banking institutions with consolidated assets below $100 billion will also be eligible to obtain capital from the CAP after a supervisory review.

Hmmm, let’s see … preferred security … converts into common equity … discounted conversion price … why, they must be talking about voting shares! The “n” word! Why don’t they just come out and say it?

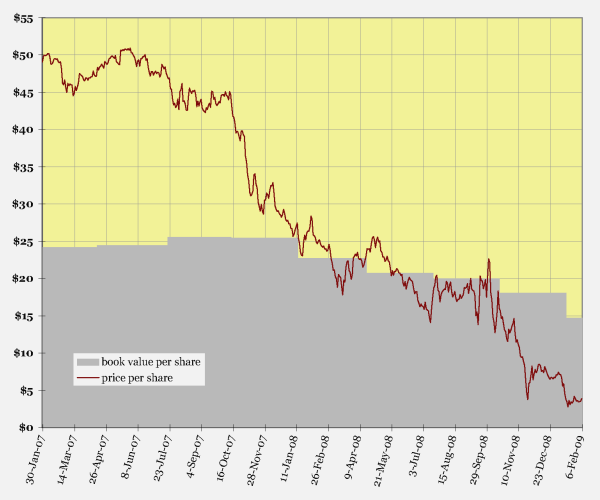

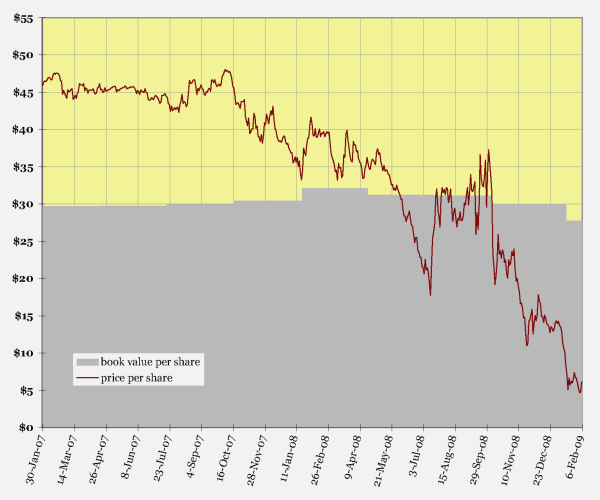

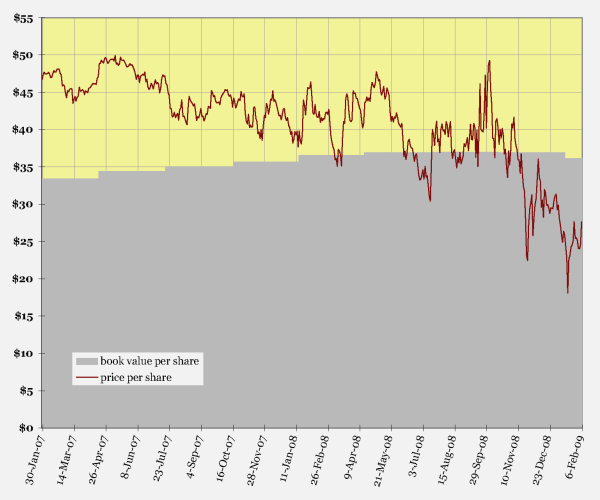

Doesn’t matter. Treasury’s half-assed proposal has so undermined hopes for a shareholder bailout that the market now sees no alternative to nationalization. This (I submit) is why the big banks’ share prices dropped like they did today. At the close:

Citigroup — 22.8% of reported book value

Bank of America — 20.0% of reported book value

JP Morgan Chase — 68.1% of reported book value

Pricing nationalization risk

At this point, my guess is that the three biggest banks’ share prices are based less on estimates of realizable asset values and more on the perceived likelihood that the government will rescue the banks without admitting that they are insolvent, that nationalization — the new “n” word — will continue to be something not discussed in polite company and that existing shareholders won’t suffer the catastrophic dilution they so clearly have coming to them. Look for a jump in tomorrow’s closing prices after the announcement of Geithner’s bailout package.

Citigroup

(currently trading at 26.6% of book value)

Bank of America

(currently trading at 22.1% of book value)

JP Morgan Chase

(currently trading at 76.4% of book value)

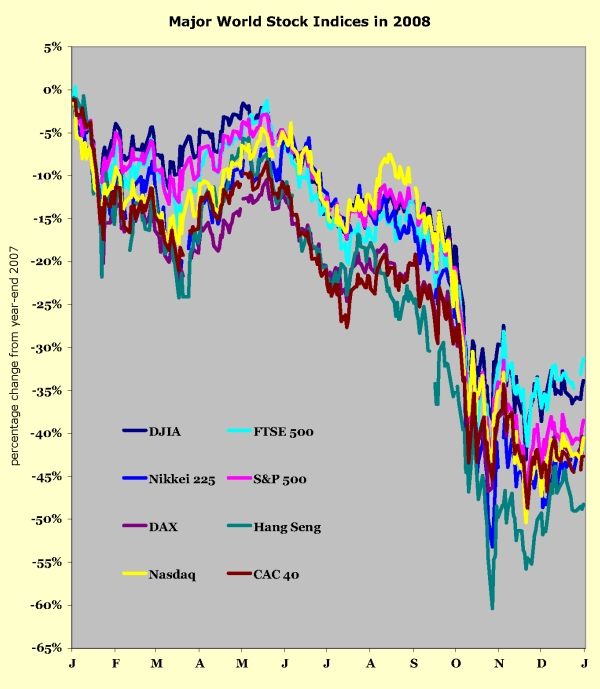

We will all go together when we go

An impressionist’s view of the global equity markets in 2008 — eight index lines tumbling down, a cascade of loss.

See the waves of synchronized selling, the major U.S., European and Asian indices moving together in a shaky dance. Falling, recovering and finally capitulating, ending the year crashed on the floor, disoriented and spastic. There is no de-linking of global financial markets. There is universal suffering.

Which, as Tom Lehrer noted, has a bright side.

Emergency Financial Assistance for Law Firms

Proposed Program

A portion of the $700 billion authorized under the Emergency Economic Stabilization Act of 2008 (the “Act”) will be used to fund the Client Receivables Acquisition Program (“CRAP”).

Law firms eligible to participate in CRAP may sell client receivables to the U.S. government, thereby receiving payment for fees billed to clients who are unable, unwilling or unaware of their obligation to pay for legal advice.

Law Firm Eligibility

To be eligible to participate in CRAP, a law firm must have —

- its head office in the U.S.,

- “significant operations” in the U.S., or

- “substantial ambitions” in the U.S.

An eligible law firm must also belong to one of the following categories:

Law firms that are deemed to be “financial institutions” within the meaning of the Act. A law firm may be treated as a financial institution if the average age of its inventory and client receivables is equivalent to 12 or more working capital weeks or if Treasury determines that the firm has otherwise become, in effect, a provider of long‑term financing to its clients.

Law firms whose participation in CRAP is “necessary to promote financial market stability” for purposes of the Act. If more than 50% of a law firm’s annual revenues (on an accrual basis) are from clients who are “financial institutions” within the meaning of the Act, then Treasury may determine that purchases of the firm’s client receivables are necessary to promote financial market stability.

Law firms whose impact on local economic conditions is deemed to be unusually significant. Under program guidelines to be issued by Treasury, eligibility for participation in CRAP may be extended to a law firm whose overhead expenses on a per-lawyer basis exceed 120% of the average for its peer group, or if the firm is otherwise determined to have an unusually significant impact on the local labor, real estate or catering markets.