Just when you thought it was safe to have faith in your government:

Public-Private Investment Fund: One aspect of a full arsenal approach is the need to provide greater means for financial institutions to cleanse their balance sheets of what are often referred to as “legacy” assets. Many proposals designed to achieve this are complicated both by their sole reliance on public purchasing and the difficulties in pricing assets. Working together in partnership with the FDIC and the Federal Reserve, the Treasury Department will initiate a Public-Private Investment Fund that takes a new approach.

Public-Private Capital: This new program will be designed with a public-private financing component, which could involve putting public or private capital side-by-side and using public financing to leverage private capital on an initial scale of up to $500 billion, with the potential to expand up to $1 trillion.

Private Sector Pricing of Assets: Because the new program is designed to bring private sector equity contributions to make large-scale asset purchases, it not only minimizes public capital and maximizes private capital: it allows private sector buyers to determine the price for current troubled and previously illiquid assets.

I’m sorry, but … what? Private sector buyers are already allowed to determine the price of troubled/illiquid assets — it’s just that the price they are willing to pay is well south of the price banks are willing to accept. So is the “public” component intended simply to provide liquidity to potential buyers, à la TALF, or is it really meant to influence bid prices?

Say the “side-by-side” government financing takes the form of a non-recourse loan, or a senior limited partnership interest with a fixed return. (“We are exploring a range of different structures for this program,” announced Geithner at 11:29 am, setting off a wave of panic selling.) Say the private sector holders of the equity or residual interest only have to put up a fraction of the purchase price, limiting their downside exposure, while keeping unlimited upside. Will this encourage buyers to raise their bids? Presumably, we’re talking about private equity types here, never ones to leave money on the table, but suppose — just suppose — the government stop-loss is enough to close the gap between the bid and ask prices. What an accomplishment: the government insures the private sector buyers against risk of loss, the buyers generously offer to share their subsidy with the banks that sell the troubled/illiquid assets, and the taxpayer (oh, yeah … her) gets an upside participation in nothing at all.

What’s more likely, of course, is that the government financing/subsidy won’t result in bids high enough to persuade many banks to sell, because to sell would be to realize huge embedded losses, and to realize such losses would be to face insolvency. Which brings us back, after a long detour through Public-Private Neverland, to the actual centerpiece of the Financial Stability Plan, the nuke in its “arsenal” of financial resources, carefully camouflaged behind a screen of incoherent prose:

Capital Assistance Program: While banks will be encouraged to access private markets to raise any additional capital needed to establish this buffer, a financial institution that has undergone a comprehensive “stress test” will have access to a Treasury provided “capital buffer” to help absorb losses and serve as a bridge to receiving increased private capital. While most banks have strong capital positions, the Financial Stability Trust will provide a capital buffer that will operate as a form of “contingent equity” to ensure firms the capital strength to preserve or increase lending in a worse than expected economic downturn. Firms will receive a preferred security investment from Treasury in convertible securities that they can convert into common equity if needed to preserve lending in a worse-than-expected economic environment. This convertible preferred security will carry a dividend to be specified later and a conversion price set at a modest discount from the prevailing level of the institution’s stock price as of February 9, 2009. Banking institutions with consolidated assets below $100 billion will also be eligible to obtain capital from the CAP after a supervisory review.

Hmmm, let’s see … preferred security … converts into common equity … discounted conversion price … why, they must be talking about voting shares! The “n” word! Why don’t they just come out and say it?

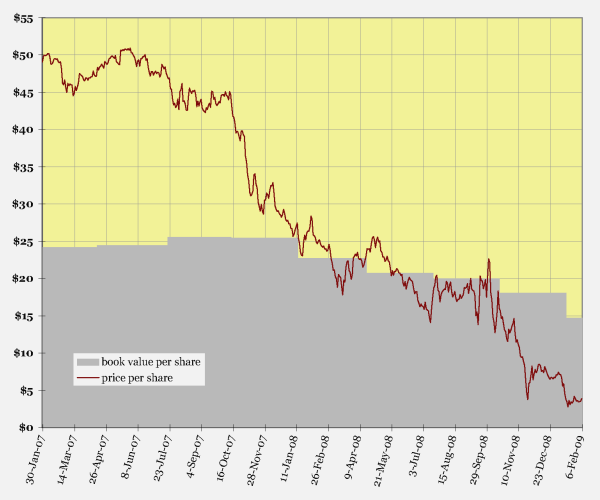

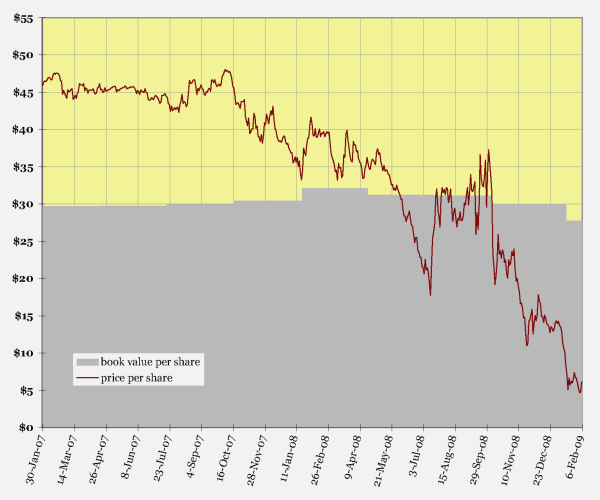

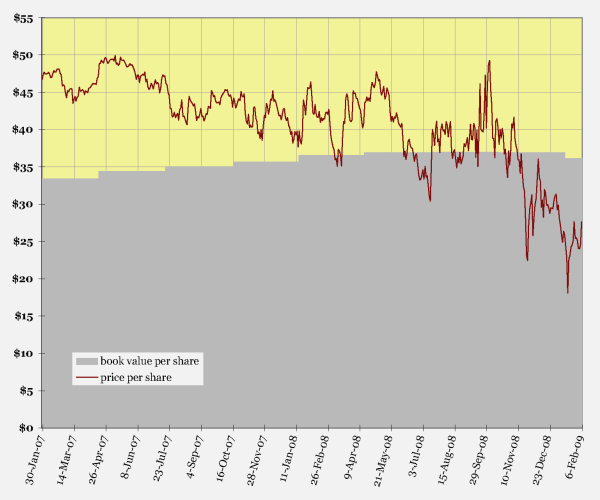

Doesn’t matter. Treasury’s half-assed proposal has so undermined hopes for a shareholder bailout that the market now sees no alternative to nationalization. This (I submit) is why the big banks’ share prices dropped like they did today. At the close:

Citigroup — 22.8% of reported book value

Bank of America — 20.0% of reported book value

JP Morgan Chase — 68.1% of reported book value